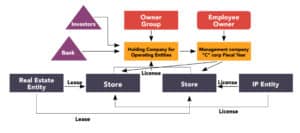

I am often asked what is the best legal structure for a multiunit operator. The answer can vary in a number of ways, especially if you have more than one concept which can necessitate a specific structure. Normally if it’s a franchise, the franchisor requires its concept be in its own entity. The structure may depend on where the stores are located–in specific regions or dispersed throughout the country? Many of the questions concern the issues of liability. For example, certain states allow self-insurance for workers compensation, so in that case, perhaps each store should be an individual entity. To help walk you through a structure, below is a diagram I use.

First, it is important to have a holding company that owns the individual stores, or owns a subsidiary holding company for a specific concept or region. It makes sense to use multiple operating entities. By having individual operating entities you can limit your liability from company to company or store to store.

In most cases, LLCs are being used, but there may be a reason to use a corporation, particularly if you want to attract a sophisticated investor group or you have potential for an IPO. Typically, we form our entities in Delaware, because Delaware law is universally understood which assists with financing and legal opinions.

Stores in separate entities may seem complicated, but it makes subsidiaries by affiliated entity able to be consolidated so you’ll have one financial statement for the bank. You’ll want individual financial statements for the affiliate entities/stores for creditor issues. This approach allows you to maintain appropriate corporate formalities.

Good Co. / Bad Co.

If you have stores that are somewhat problematic or have some downside risks when they open, it’s always good to keep those stores in separate entities, what I refer to as “Bad Co.” It’s difficult to spin off the bad stores after the fact.

For non-franchise restaurants to take advantage of opportunities, they need to keep intellectual property (IP), including names, in a separate entity and then license the IP to the operating entities. That will afford you greater protection and if something goes wrong, you still have protected your name and IP. If you want to franchise your concept, then you have the ability to license the IP to a franchise entity and reserve some type of protection.

When it comes to financing this structure, you have the option to either have the financing at the Hold Co. or the subsidiary level. Containing your financing to individual store entities is preferable because you can eliminate cross collateralization and hopefully guarantees. If you anticipate there will be times you’ll want the money to be dispersed among various entities, having the financing at the Hold Co. level may be the appropriate structure. You have the same option with investors. In most cases, the investors want to invest in the Hold Co., but at times you may use a cash-flow model and sell investor interest at the individual store-entity level.

Another important structure is to keep the real estate separate and lease the real estate to the individual stores. The real estate entity can be used for estate planning by having it owned by a family partnership to be used as a legacy asset, and also used for sale and leaseback in the future.

The last piece which some accountants think is more trouble than it’s worth is to set up a management company and then charge the individual stores a management fee.

From the May 2022 issue of Restaurant Finance Monitor

Author

-

Co-founder and chairman of Monroe Moxness Berg PA, Dennis is a pioneer in corporate financing with a broad network of finance contacts and clients. He assists businesses, from emerging companies to multi-national firms, by providing creative ideas, identifying unique financing sources, and developing the financial tools necessary for their growth and development.